- #TURBOTAX FREE ONLINE TAX FILING FOR FREE#

- #TURBOTAX FREE ONLINE TAX FILING UPDATE#

- #TURBOTAX FREE ONLINE TAX FILING FULL#

- #TURBOTAX FREE ONLINE TAX FILING SOFTWARE#

This guarantee cannot be combined with the TurboTax Satisfaction (Easy) Guarantee. Audit Defence and fee-based support services are excluded. Claims must be submitted within sixty (60) days of your TurboTax filing date, no later than (TurboTax Home & Business and TurboTax 20 Returns no later than July 15, 2022). TurboTax Free customers are entitled to a payment of $9.99. If you get a larger refund or smaller tax due from another tax preparation method, we'll refund the amount paid for our software.This guarantee does not apply to TurboTax Free.

#TURBOTAX FREE ONLINE TAX FILING FULL#

Testimonials are based on TurboTax Online reviews from tax year 2020 as well as previous tax years.Actual connection times and availability may vary. to 6 p.m., ET, Monday to Friday (except holidays). After May 2, English and French hours of operation will be 9 a.m. ET for French during tax season (from February 22 to May 2, 2022). to 12:00 midnight ET, 7 days a week for English, and 9 a.m. TurboTax experts are available from 9 a.m.All prices are subject to change without notice. TurboTax Online prices are determined at the time of print or electronic filing.Includes field audits through the restricted examination of books, but does not include the "detailed financial audit".

Does not include GST/HST and other non-income tax audits and reviews unless the issues are ancillary to the income tax review itself.

#TURBOTAX FREE ONLINE TAX FILING UPDATE#

Internet connection and acceptance of product update is required to access Audit Defence.Over the past 5 years, more than 24M returns have been electronically filed (using NETFILE) with TurboTax based on CRA NETFILE reporting.Support availability subject to occasional downtime for systems and server maintenance, company events, observed Canadian holidays and events beyond our control. Intuit reserves the right to limit each telephone contact. For Basic, Standard, Premier, Home & Business, Deluxe Online, Premier Online, and Self-Employed Online, technical support by phone is free.

#TURBOTAX FREE ONLINE TAX FILING SOFTWARE#

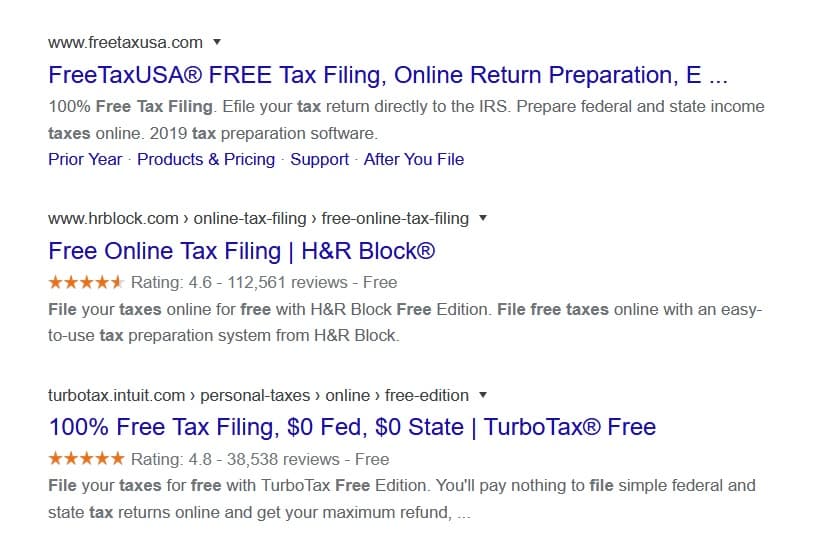

The TurboTax lawsuit is filed on behalf of the people of California and says that the “abysmal participation rate” in the IRS Free File Program is partly attributable to TurboTax “aggressively marketing as ‘Free’ an inferior, watered-down version of their software that is useless to all but those with the simplest of tax returns.”

#TURBOTAX FREE ONLINE TAX FILING FOR FREE#

The Los Angeles City Attorney filed a lawsuit against Intuit, the maker of TurboTax, stating that “Intuit has for yearsĭefrauded the lowest earning 70 percent of American taxpayers-who are entitled under a private industry agreement with the IRS to file their taxes online for free.” The lawsuit complaint accuses Intuit of “actively undermining public access to the IRS’s ‘Free File’ program.” The complaint points out that while 100 million taxpayers were eligible to file for free under the IRS Free File Program, only 2.5 million taxpayers used the program. Despite the appeal-which will likely be a lengthy process-the Court said that it will allow the case to proceed on our challenge to Intuit’s practices, and the Court ordered the parties to propose a schedule for presenting legal arguments.ĬA Government Official Files TurboTax Free File Lawsuit Intuit has already appealed the Court’s Order. According to the order,īecause the Terms were too inconspicuous to give Plaintiffs constructive notice that they were agreeing to be bound by the arbitration agreement when they signed in to TurboTax, the Court finds that Plaintiffs did not agree to the arbitration provision.īased on this ruling, claims on behalf of consumers in the TurboTax Class Action Lawsuit will now be allowed to proceed before one judge in federal court, rather than in confidential, binding arbitrations. The Court agreed with our arguments that the hyperlinks to the Terms of Use were too inconspicuous and confusing, particularly where less than 0.55% of users actually clicked on the Terms. In its order, the Court found that the TurboTax Terms of Use did not force customers to give up their right to sue in court. On March 12, 2020, the Court denied Intuit’s Motion to Compel Arbitration. Turbo Tax Class Action Lawsuit Update: Court Denies Motion to Compel Arbitration

0 kommentar(er)

0 kommentar(er)